The Financial Safety Service

Carefull guards your money, credit, and identity from threats, thieves, and everyday money mistakes.

You can text or call us at (833) 836-0050

The Financial Safety Service

Carefull guards your money, credit, and identity from threats, thieves, and everyday money mistakes.

You can text or call us at (833) 836-0050

Trusted by:

Financial safety means protection inside and out — from scammers, but also our own occasional slip-ups.

Outside THREATS

The latest digital fraud, scams and identity theft, including schemes targeting seniors.

$8.8

BILLION

estimated losses in 2022

INSIDE THREATS

Simple financial mistakes, forgotten bills, lost passwords, and even theft by someone you trust

Carefull provides all-in-one financial safety, covering both outside threats and inside risks — backed by $1 million of identity theft insurance.

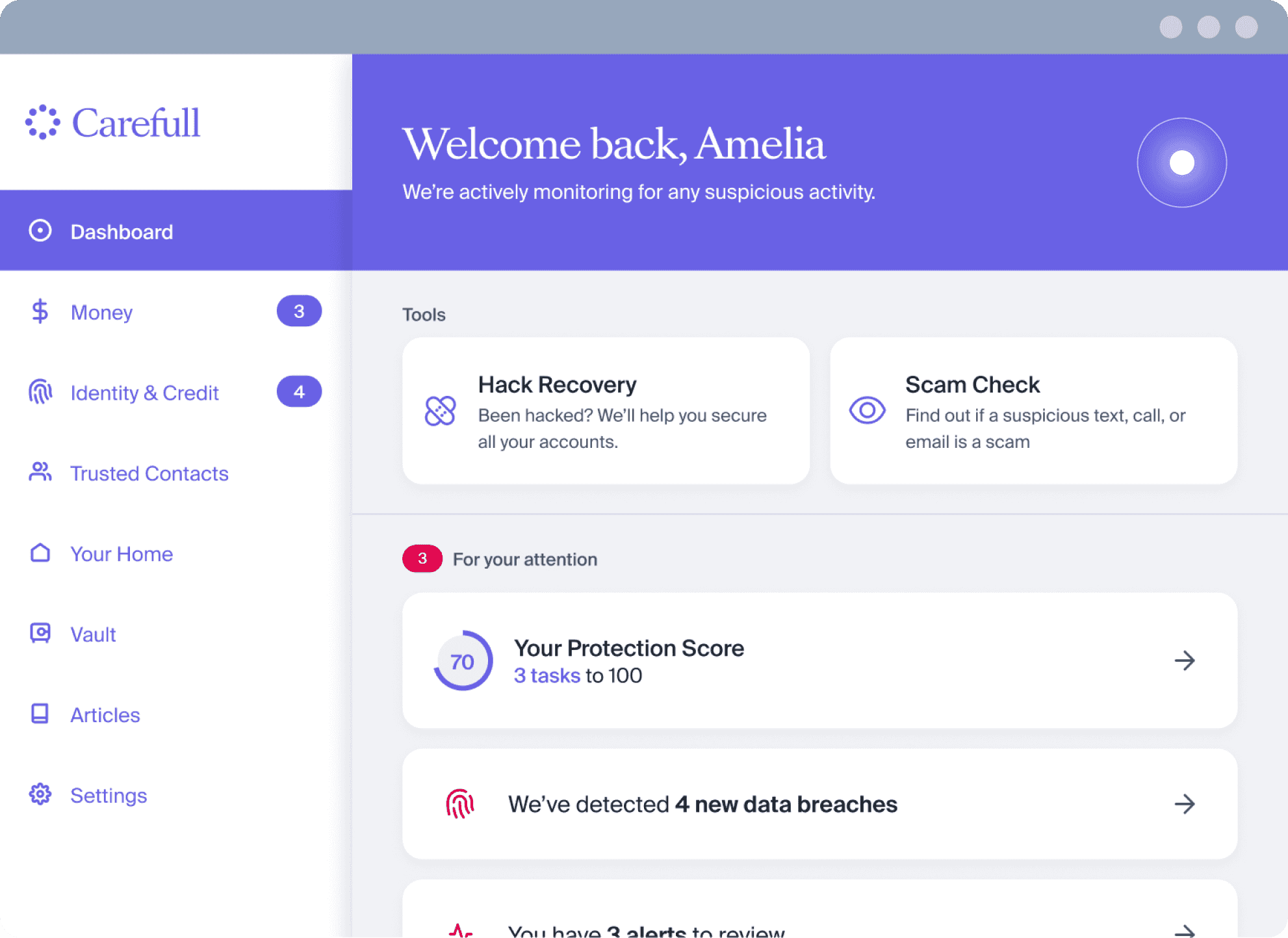

Financial safety made simple

Only what you need to know, when and where you need it

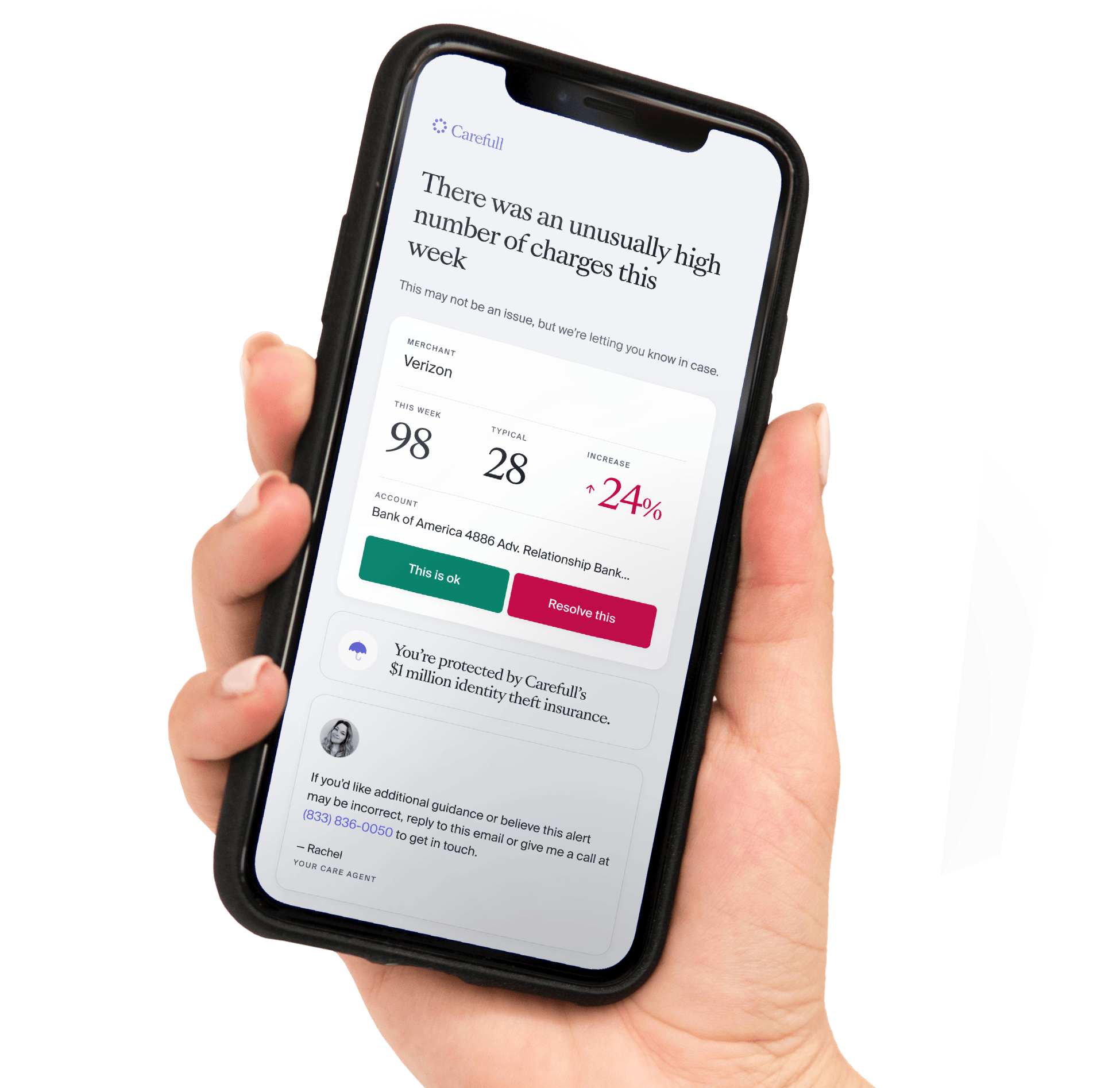

Make sure your money is spent the way you want.

Smart email alerts catch unusual activity, suspicious transactions, and simple, common mistakes

Easily customizable so you only receive the alerts you want

We look for things others don't. Carefull’s personalized monitoring is always adapting to the newest threats.

WE KEEP AN EYE OUT FOR:

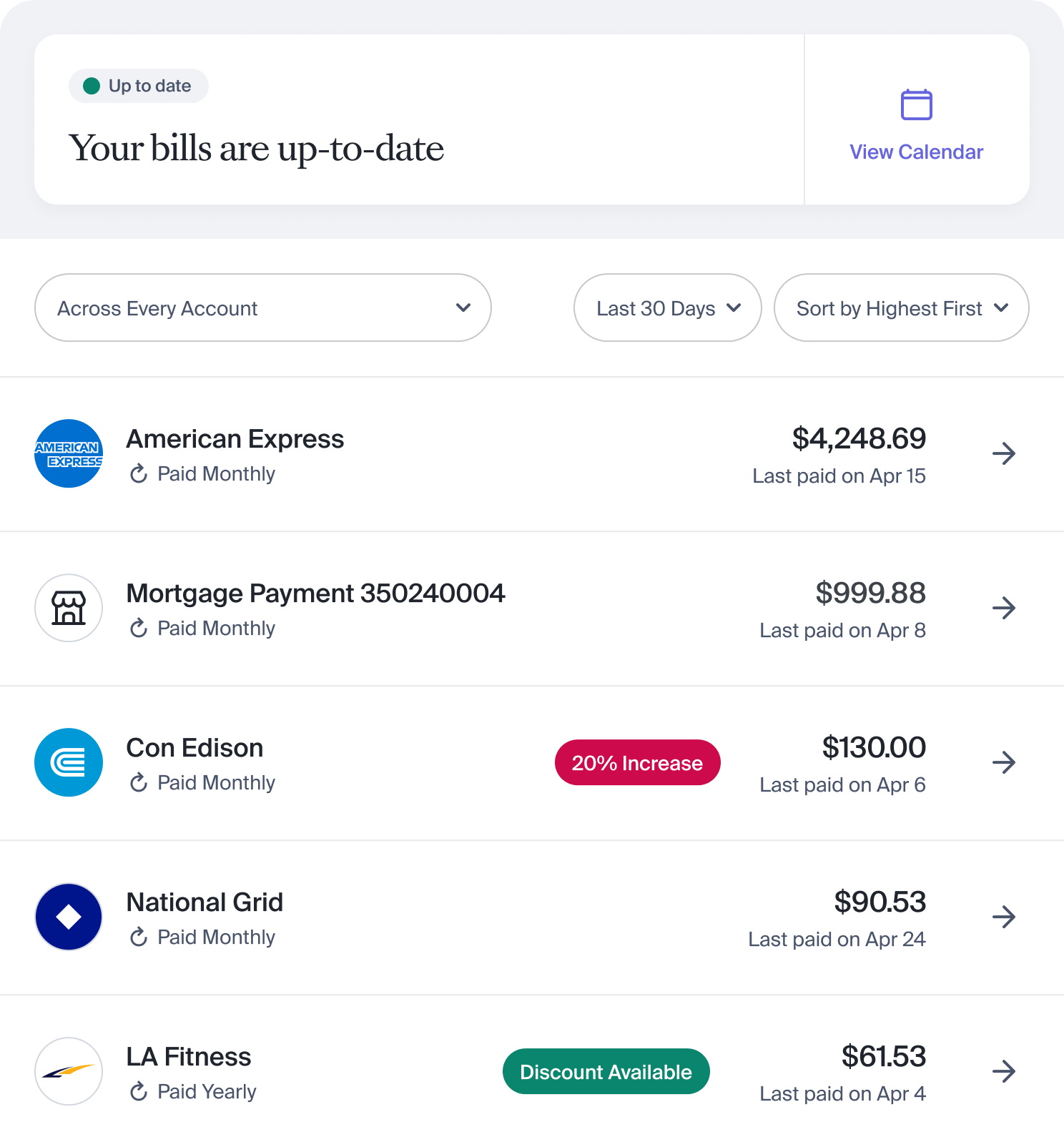

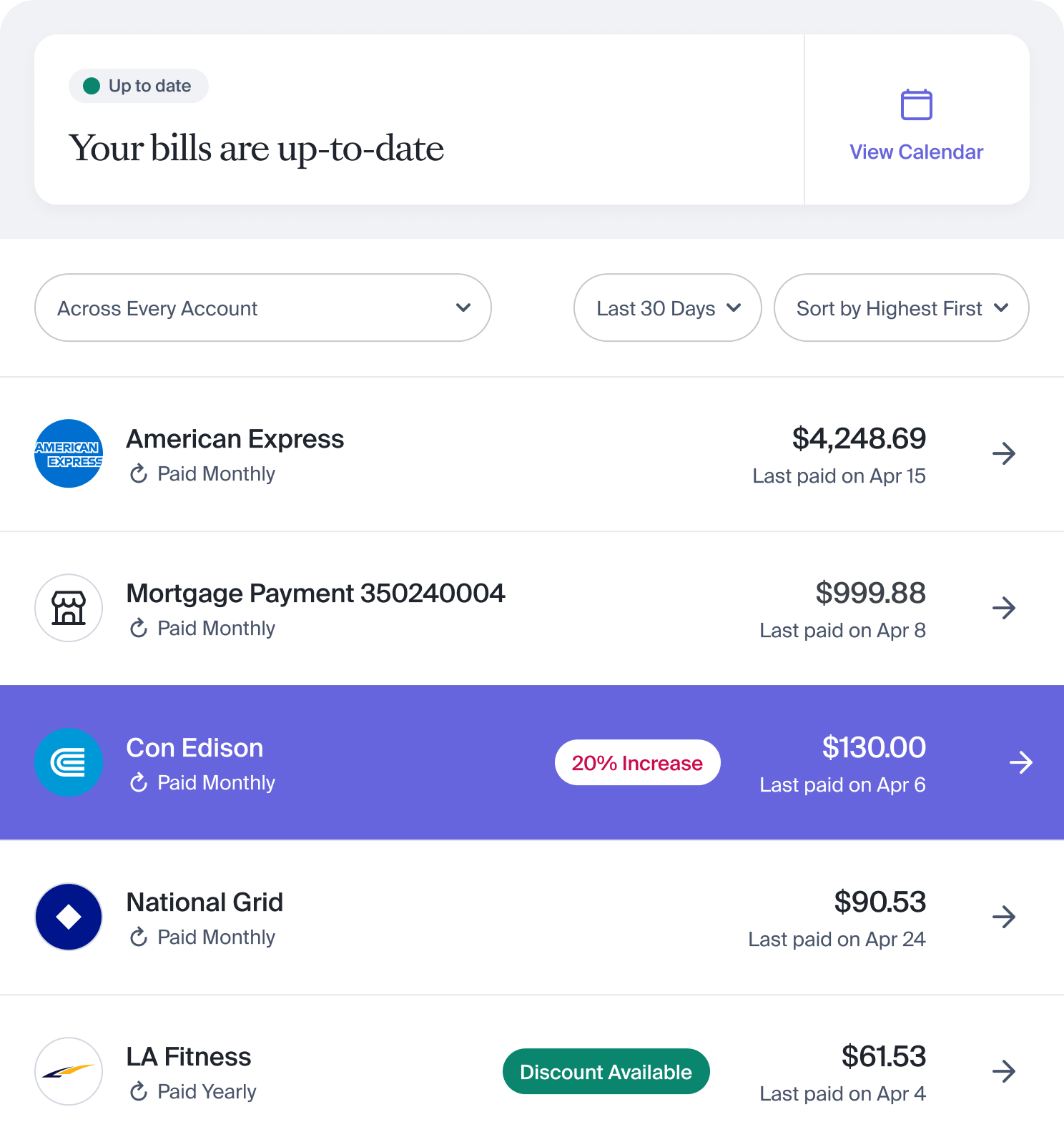

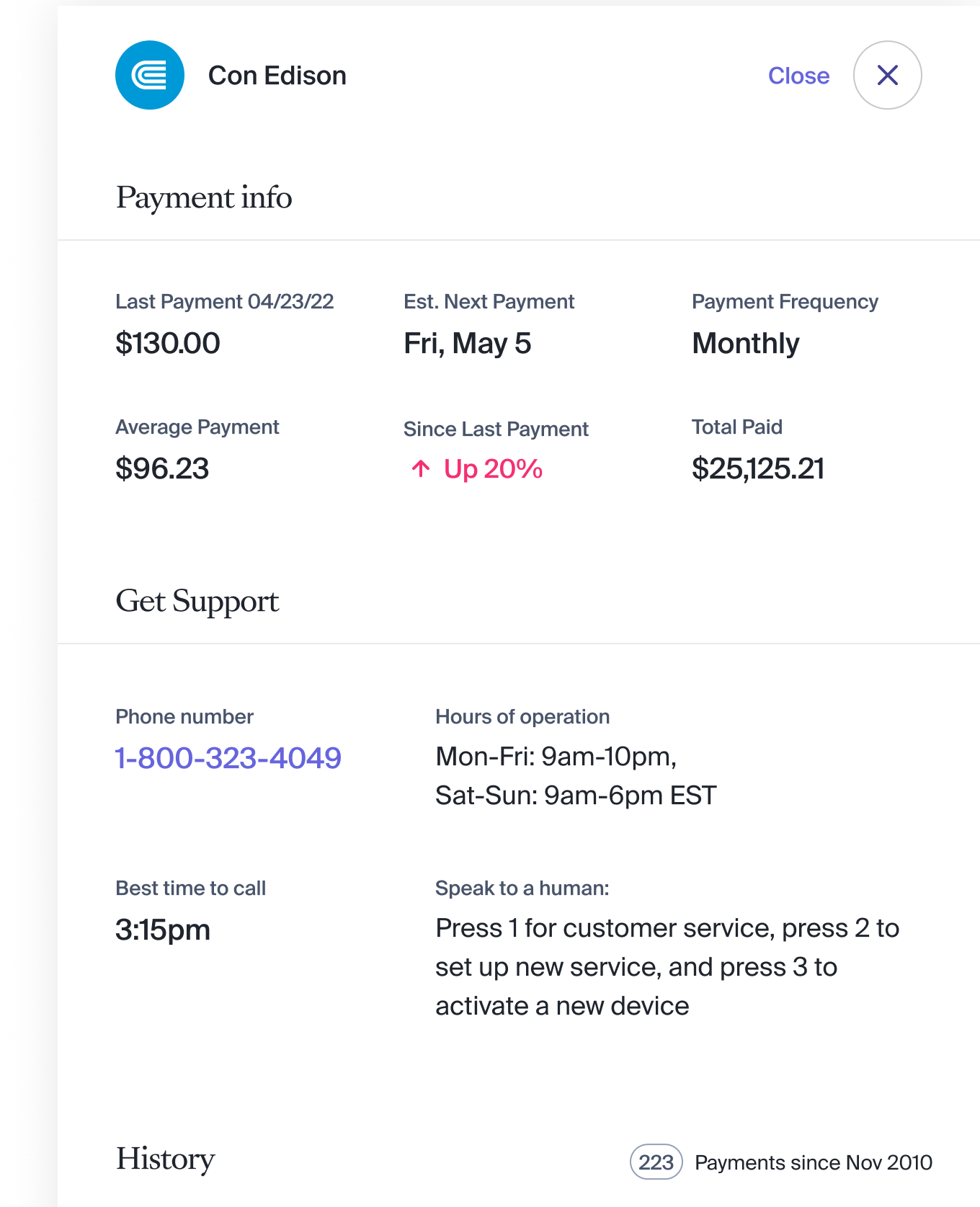

Find new ways to save and see every bill across every account.

Know every person, business or service that charges you regularly

Catch bill changes, redundant services, and see discounts on your regular services

Carefull helps you speak to a human or negotiate/cancel bills when needed

Better Business

Bureau

Smart Money

Award 2021

Banking-Tech

Award 2022

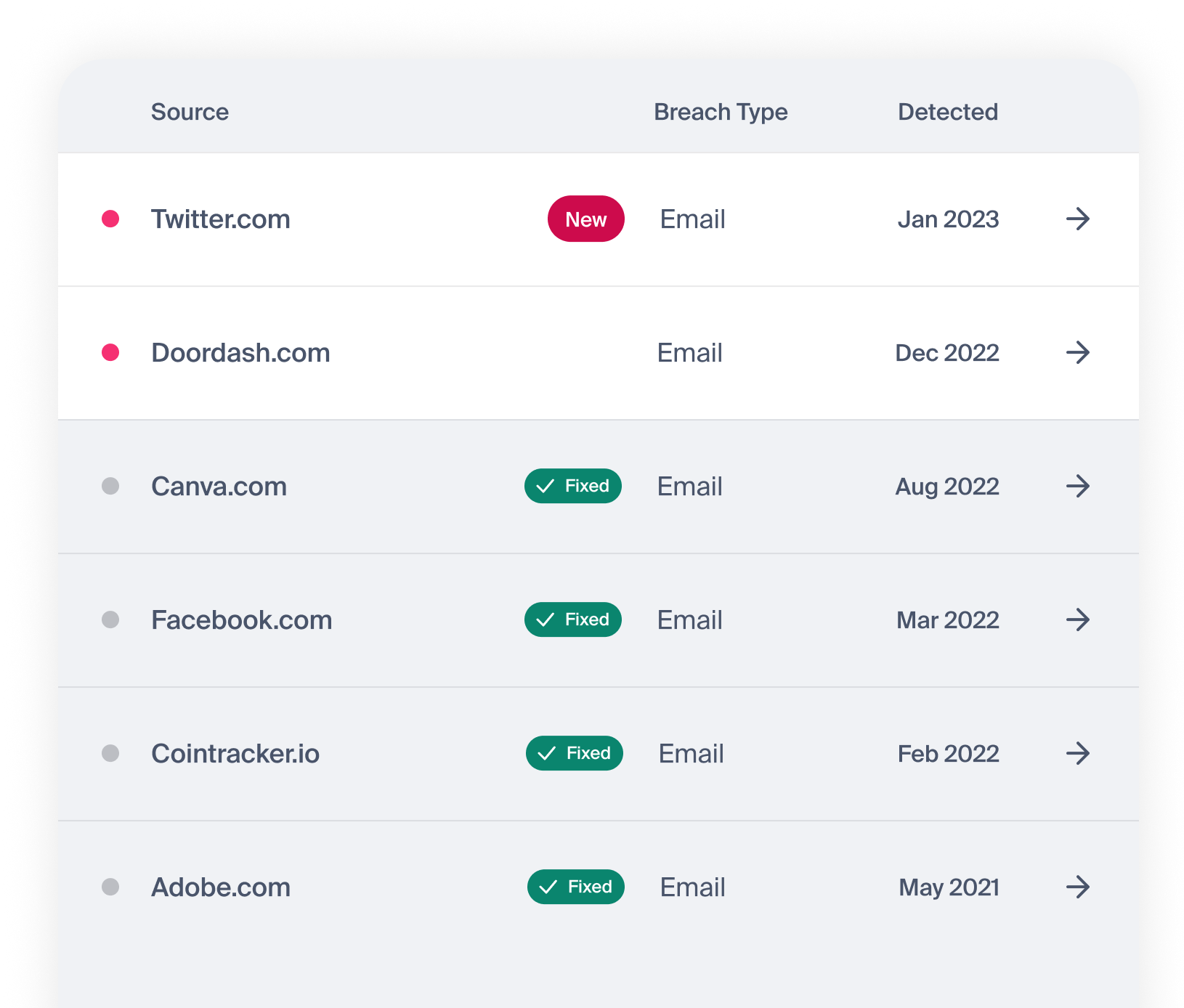

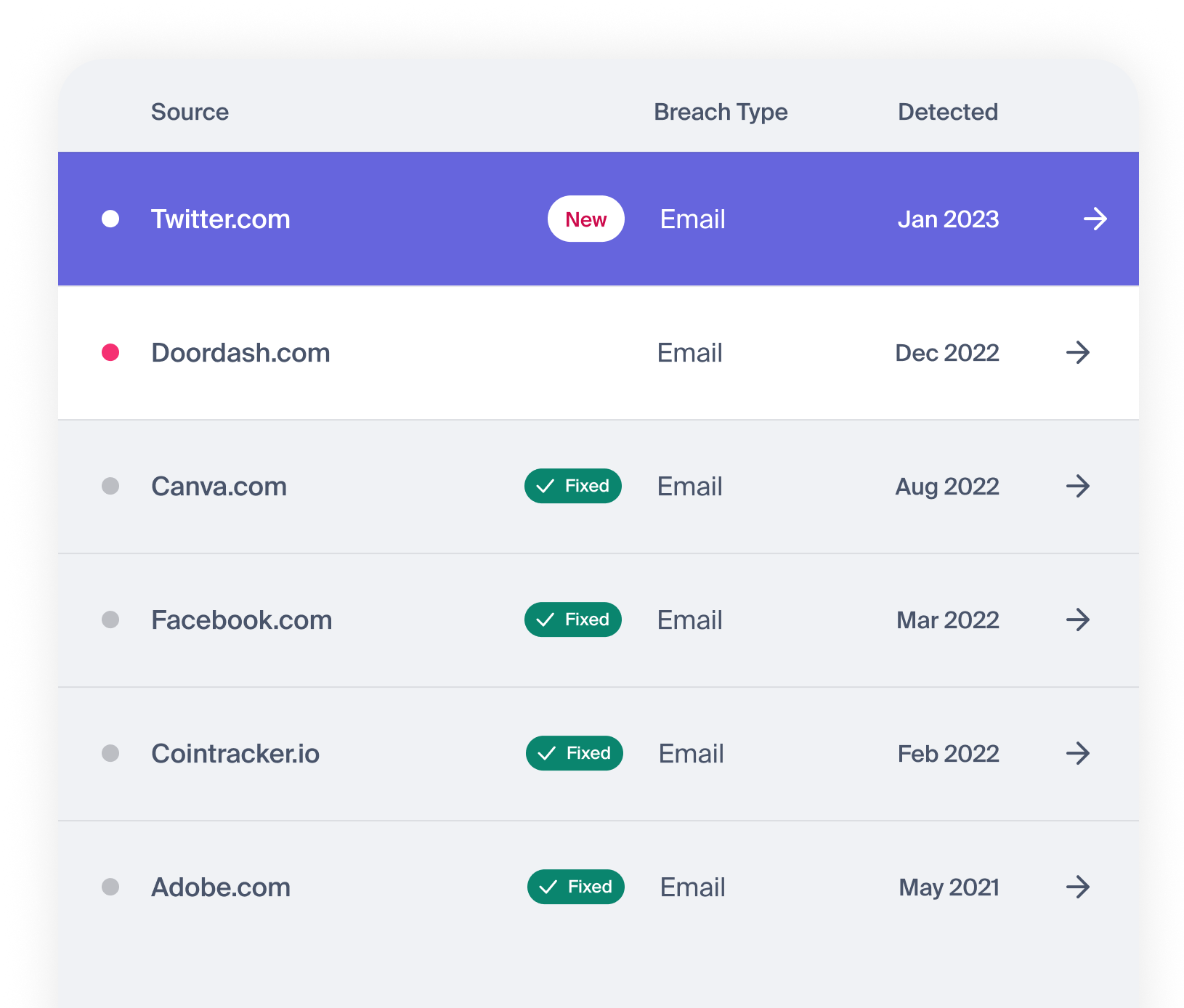

A blanket of protection for your identity & credit.

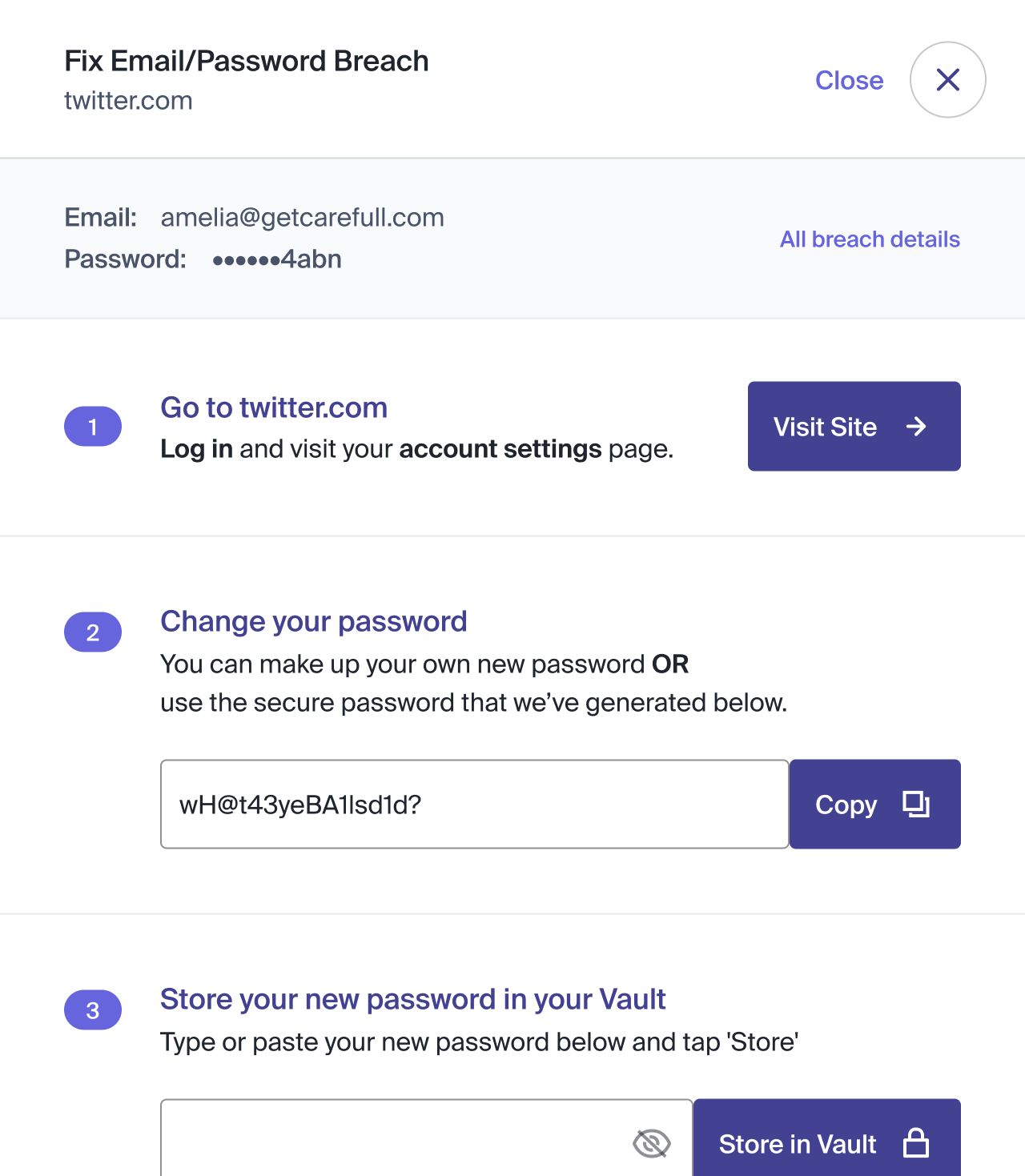

24/7 identity monitoring and tools to fix breaches

We scan the dark web 24/7 for any signs of your personal data

We’ll immediately alert you to any data breaches and help you fix them immediately

$1

MILLION

Every Carefull member is covered by

$1 million dollars of identity theft insurance

If your identity is stolen, we cover lost funds and legal fees up to $1 million*. Active as soon as you sign up.

Have questions or want to review the policy details? Email or chat with us.

Credit Monitoring

24/7 credit monitoring that finds and shows you every credit event using your name and SSN

On-demand, US-based specialists are available to help fix any issues or freeze your credit to prevent misuse

Take it from thousands of happy members, advisors, industry experts, and journalists.

Simple pricing with no surprises

Choose monthly or yearly pricing

$

29

.99

Paid every month.

$

299

Paid every year.

Save $61

What’s included

Money monitoring for unlimited accounts

Bill organization and management

Smart, customizable email alerts

Credit monitoring

Encrypted password storage

Home title monitoring

Live, US-based expert assistance

Hack recovery & scam check tools

$1M Identity Theft Insurance Policy

24/7 dark web scanning

Identity monitoring & data breach fixing

Secure sharing with family

The highest standard of

data security & privacy

For retail banks &

credit unions

For financial advisors

and wealth managers

Live

Carefully